does not include the entire universe of available offers. Along with key review factors, this compensation may impact how and where products appear across (including, for example, the order in which they appear). To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site.

#Wells fargo online wire transfer limit free#

Clicking on any offer on will direct you to the issuer's website, where you can review the current terms and conditions of the offer.Īdvertiser Disclosure: is a free online resource that offers valuable content and comparison services to users. Citi imposes various amounts depending on. Every reasonable effort has been made to maintain accurate information however, all credit card offer details, including information about rewards, signup bonuses, introductory offers, and other terms and conditions, is presented without warranty. For example, Chase Bank sets the limit at 100,000 for individuals, but offers higher limits to businesses on request. Opinions expressed on are the author's alone, not those of any credit card issuer, and have not been reviewed, approved, or otherwise endorsed by credit card issuers.

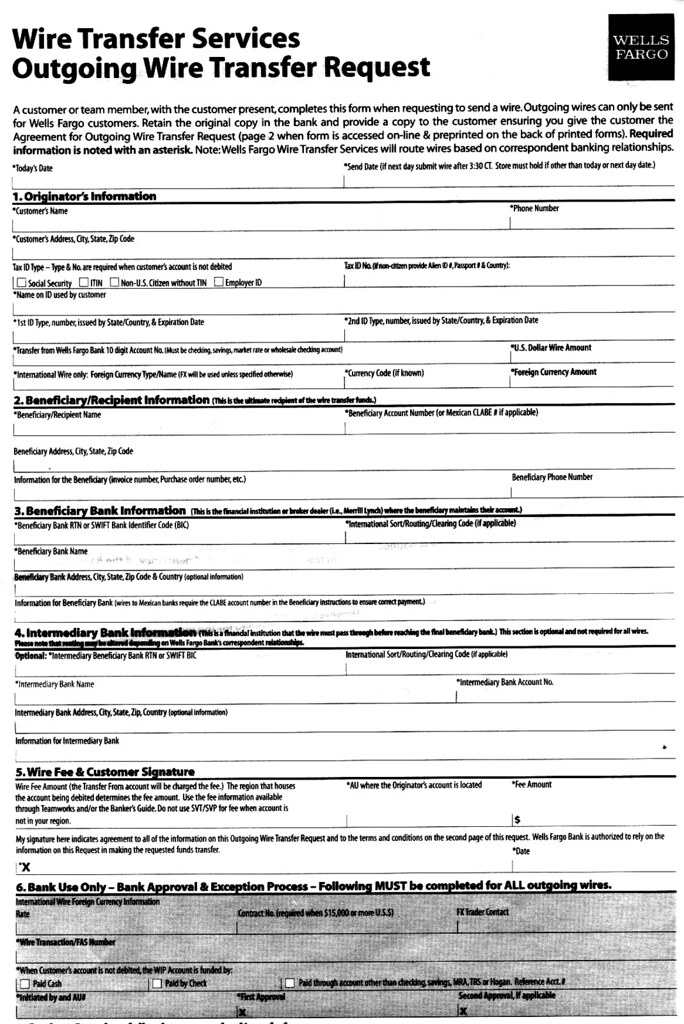

Those who have positive payment histories (no late or missed payments) and who show credit score improvement will be the most likely to obtain an increase.Įditorial Note: Our site content is not provided or commissioned by any credit card issuer(s). You will also likely be ineligible if you have had an increase within the last six months. Press 1: to initiate a wire transfer to initiate a wire transfer investigation to initiate a same day repetitive wire transfer in U.S. To initiate your wire please call Wells Fargo Wire Transfer Services toll free at 1-88. For example, if your credit card account is less than six months old, you will likely be ineligible for a credit limit increase. Please see your Wells Fargo representative for details. Not every cardholder will qualify for a CLI. While anecdotal evidence suggests Wells Fargo uses a soft credit pull if possible, hard credit pulls are not unheard of, particularly if your credit history has a few bumps. Each credit limit increase has the potential to result in a hard credit inquiry, which can have a negative impact on your credit score. You’ll need your Social Security number and credit card or account number to enroll in online banking.īefore making a request, consider if the credit limit increase is worth the possible consequences. At the moment, your Wells Fargo account has three different money transaction options: sending and receiving money with Zelle, payday loans tennessee using. If you’re not currently enrolled in Wells Fargo online banking, you can choose to do so at any time through the Wells Fargo website. In this guide, we’ll dive deeper into the Wells Fargo methods for online money transactions and break down the limits, fees, rates, and other aspects of its wire transfer functionality. You can request a Wells Fargo credit card credit limit increase through your online banking account.

0 kommentar(er)

0 kommentar(er)